Just like FMCG, banking needs distribution

For the past nine months, the plumbers of OnePipe have been hard at work putting finishing touches to our embedded banking proposition, which we've built as a use case on our API infrastructure and partnerships. For all of us, it's been an intense set of months. For me personally, it's had me on a permanent edge. Remember that RSM at your NYSC camp? Yeah, I've been in that mode for some time now. I hope everyone around me understands and forgives.

I want to put down my thoughts to describe how we see the market and how this view on the market is what's driving this direction. Hopefully, I can keep this short and sweet.

Dissecting the market

Assuming that we all agree that banking and financial services is more than a place to keep money and collect cash, but that it includes the provision of services like credit, useful savings, financial advisory, etc., then we will all likely also agree that only a tiny fraction of the Nigerian population has access to true financial services. Check am, which bank is helping people fund their kids' education or creating schemes that make it possible for the corner shop to grow from one location to two?

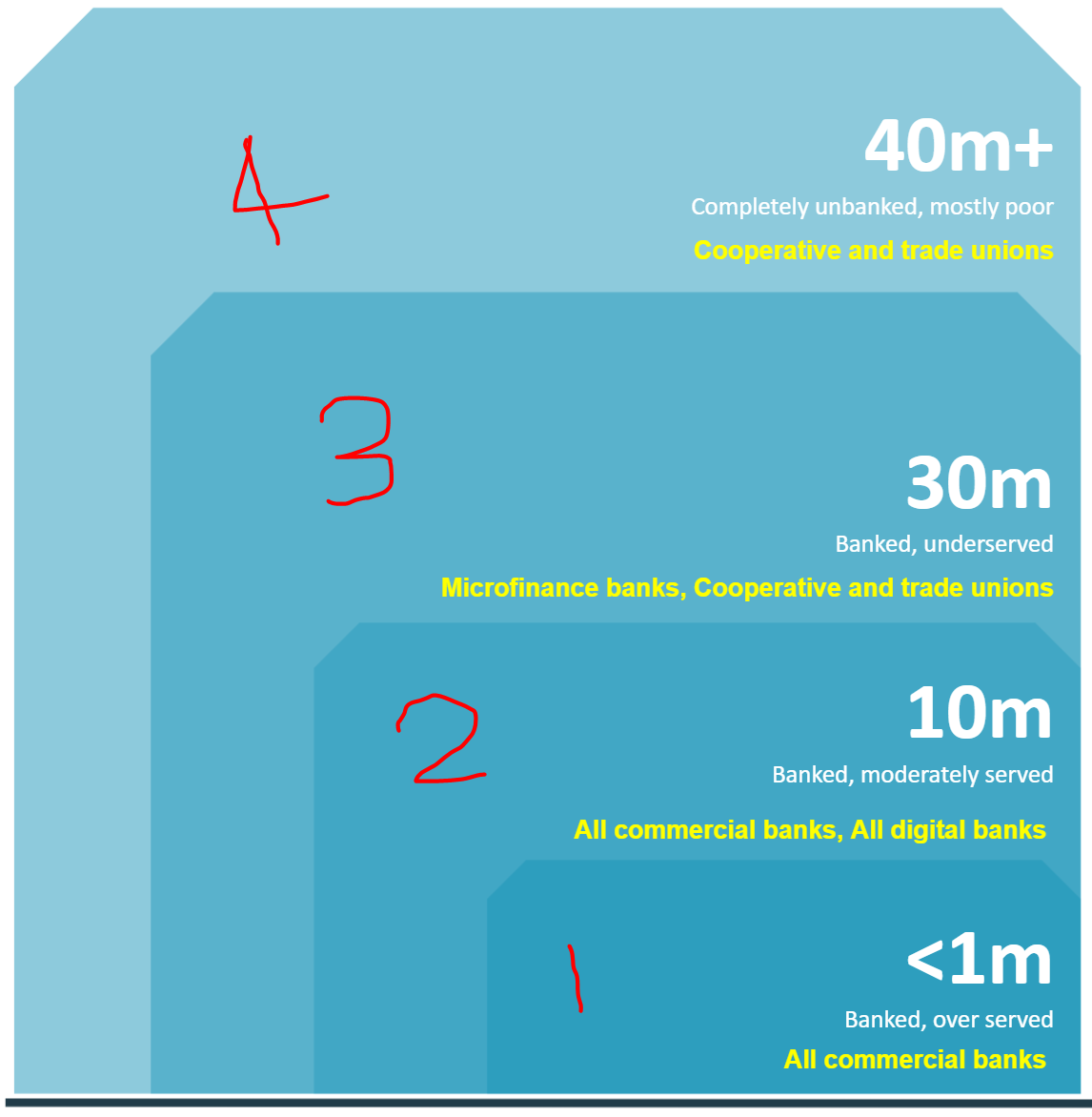

So, looking beyond account ownership and CICO, and more broadly at true financial services access, at OnePipe, here's how we see the market laid out... With the players in yellow being the ones that currently serve each segment.

Of course, we all agree that segment 4 is insanely hard to target. Identity issues alone will tire out anyone going after that segment. And low income levels will make it hard to extract any reasonable monetisation. Except you are selling "hope" and possibly fleecing people. Think religion and betting.

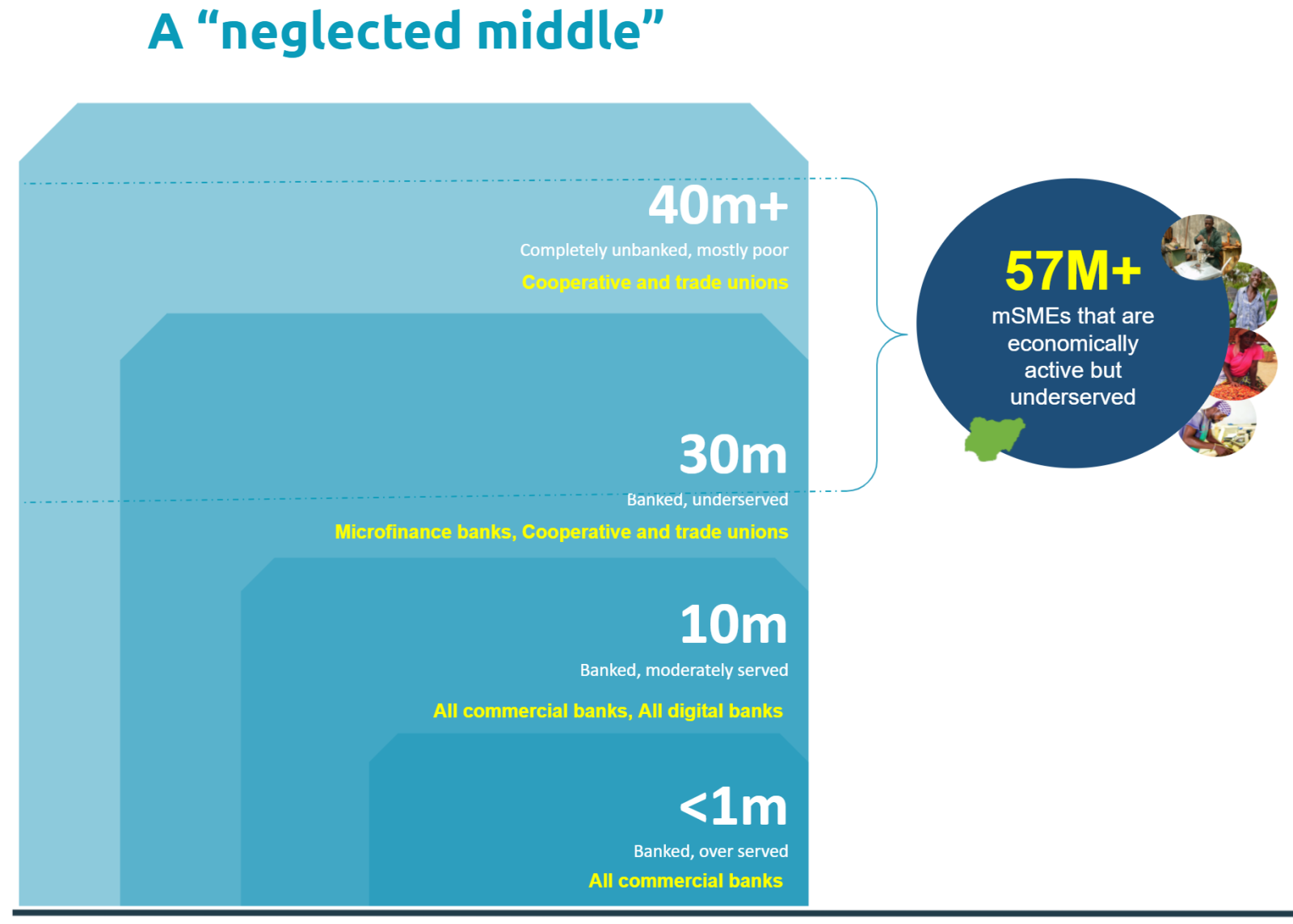

We think there's a "neglected middle" that overlaps segments 3 & 4, where yes, income levels are low, there's some account ownership, but liquidity and scale constraints make it difficult for the organisations that are playing in that segment to push harder and faster.

The interesting points to note: For the consumers in this segment, they are economically active, mostly operate in cash, predominantly in trade, agriculture and some civil service representation. They also maintain a tighter affinity towards their trade unions, religious bodies, value chain suppliers and offtakers, resident associations, etc than they will ever have towards a big faceless bank in VI. As mentioned before though, the fragmentation and sheer size of that segment makes it hard for any of the players servicing them to be able to operate at good enough scale to reach everyone with the right sets of services.

Servicing a $10 depositor is expensive

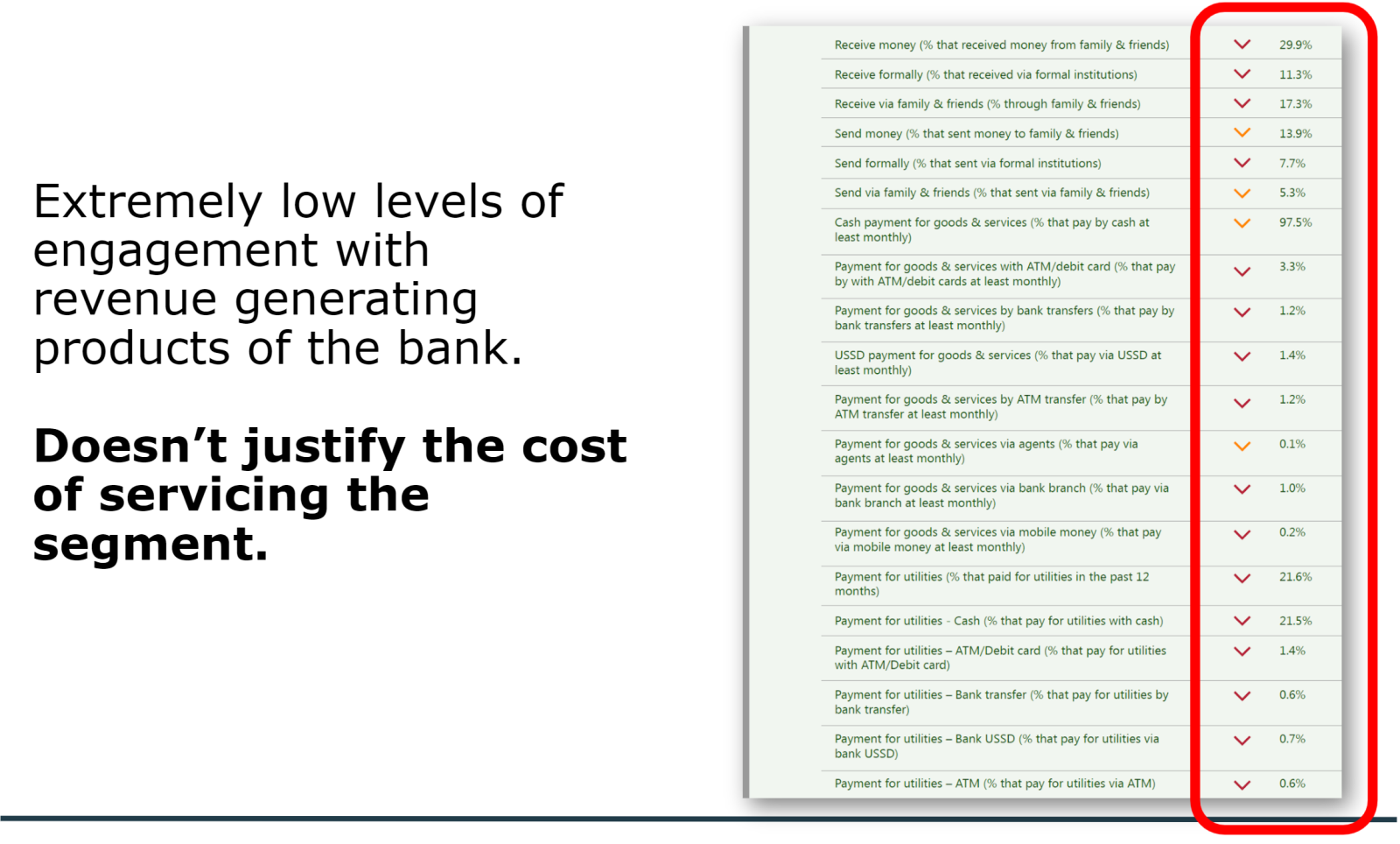

For many of our large banks, the cost of servicing the low income depositor and providing them with true financial services, really just does not add up.

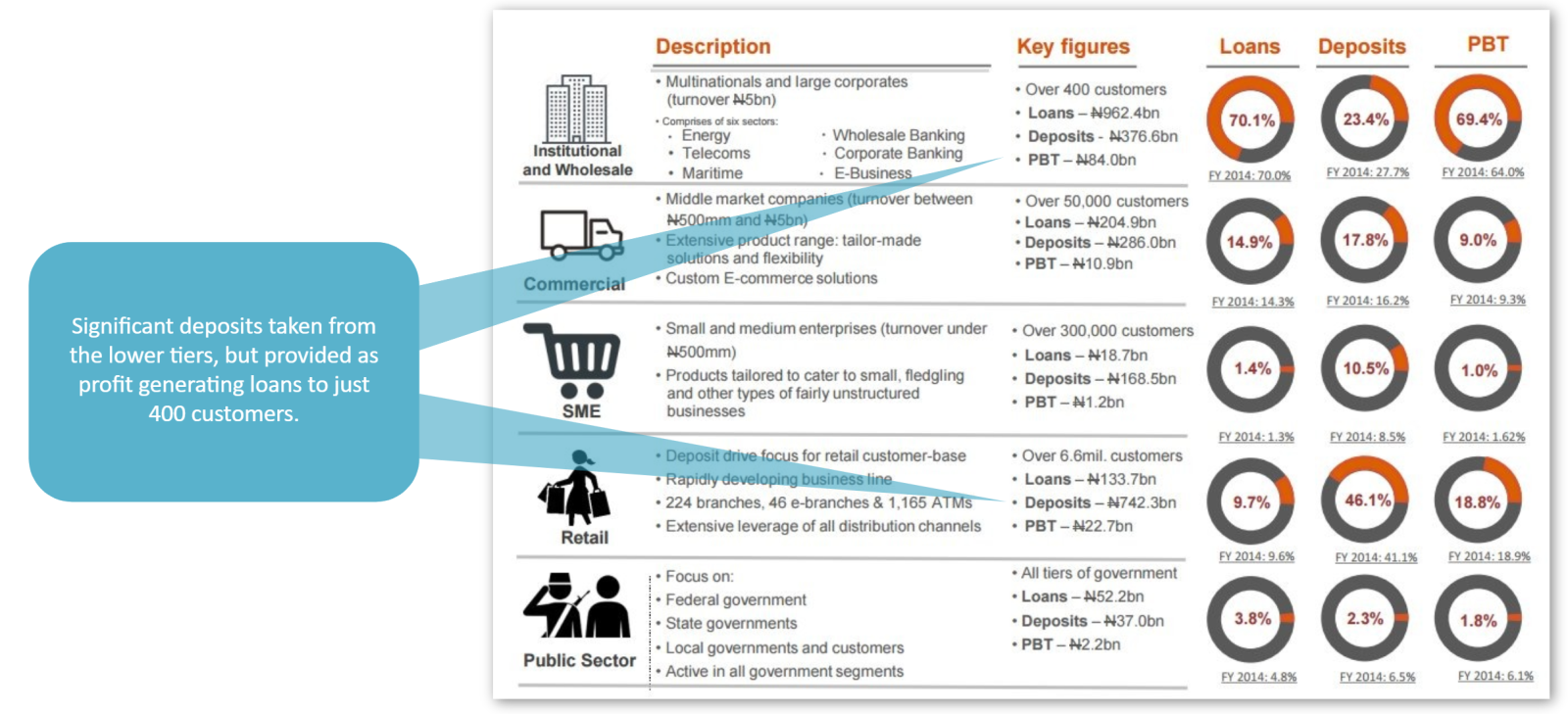

So, the big banks (actually, most commercial banks) will rather just mop up deposits from the low income segments and offer actual financial products to the richer segment. Sigh. Here's an example of 6.6m customers serving as infrastructure to generate better performing revenue from 400 customers.

Nah, you can't blame anyone. It is what it is.

Meanwhile, there's demand for even "the primitives": Savings and loans. Folks even pay to save in those segments.

So, we have agreed that:

The market is there and it's big.

Servicing it is expensive. And possibly not as profitable as servicing segments 1 and 2.

The consumers in that segment are closer to micro-finance and non-finance orgs, who don't have the scale of operations, required technology and liquidity to efficiently serve the segment.

We think this represents an opportunity.

The opportunity for embedded banking

Imagine Oghenekaro that has a shop at the end of his street...

Karo needs savings; there are better performing "savings" products from asset management companies than commercial banks.

Karo needs loans; there are more easily accessible loans from MFIs and fintechs than commercial banks.

Karo wants to take risks with her money, but betting companies are closer to her.

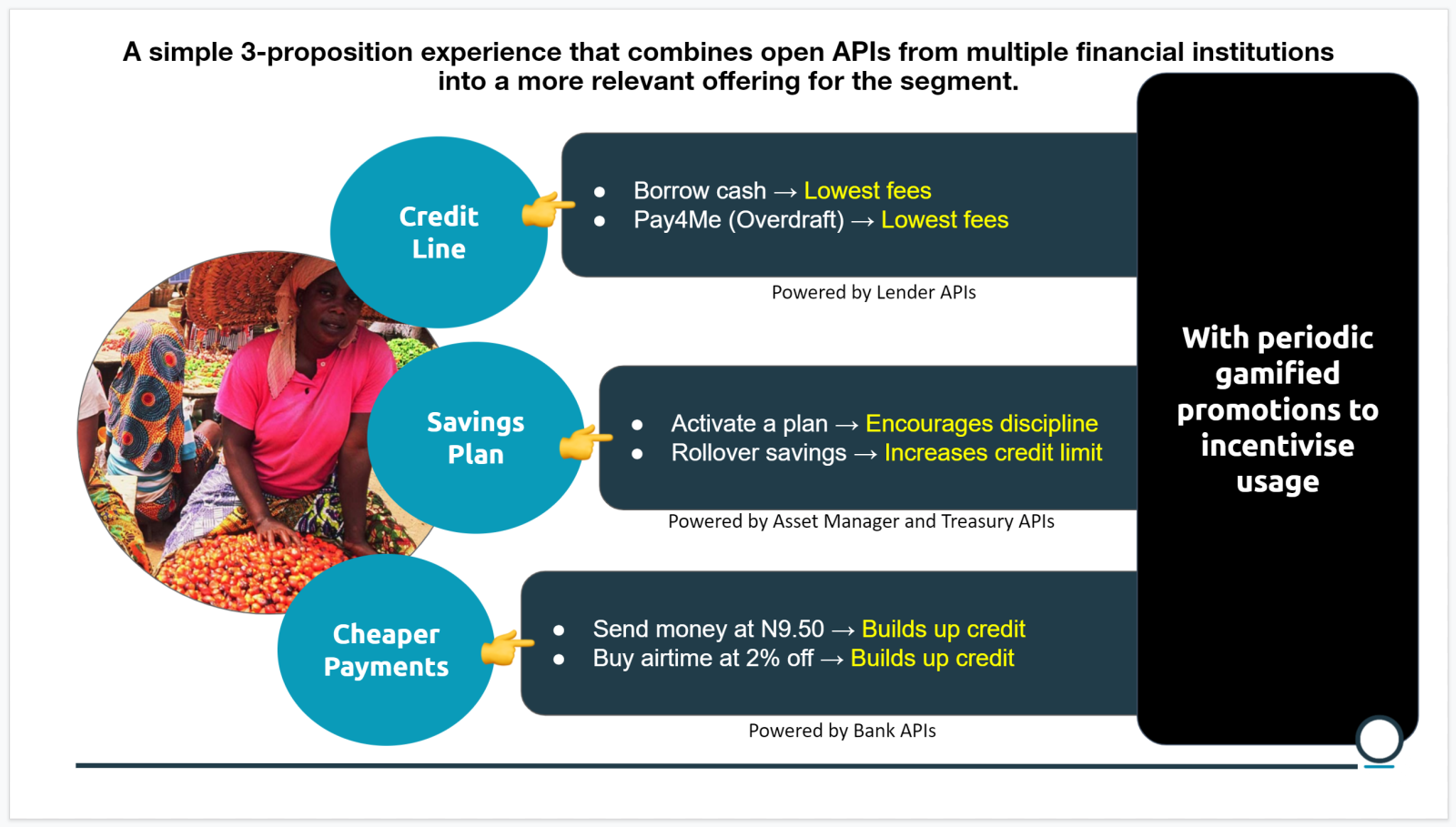

Effectively, a mishmash of propositions from different organisations, may be the best composition of financial services that speak to Karo's reality. And Karo is closer to the distributor who supplies his shop with inventory in a van every Thursday or the offtaker who comes to buy her cashew during harvest season.

And he operates in cash.

Now imagine: Being able to provide a "banking" experience delivered by the FMCG van driver, that is a combination of services from all of these organisations, but bundled into one experience that is digital-first, but allows for cash operations as well. And as Karo moves closer to the digital end of the spectrum and further away from the cash end, he gets better loans, better returns on her savings, etc. delivered to him by a contact and brand he knows and interacts with more regularly.

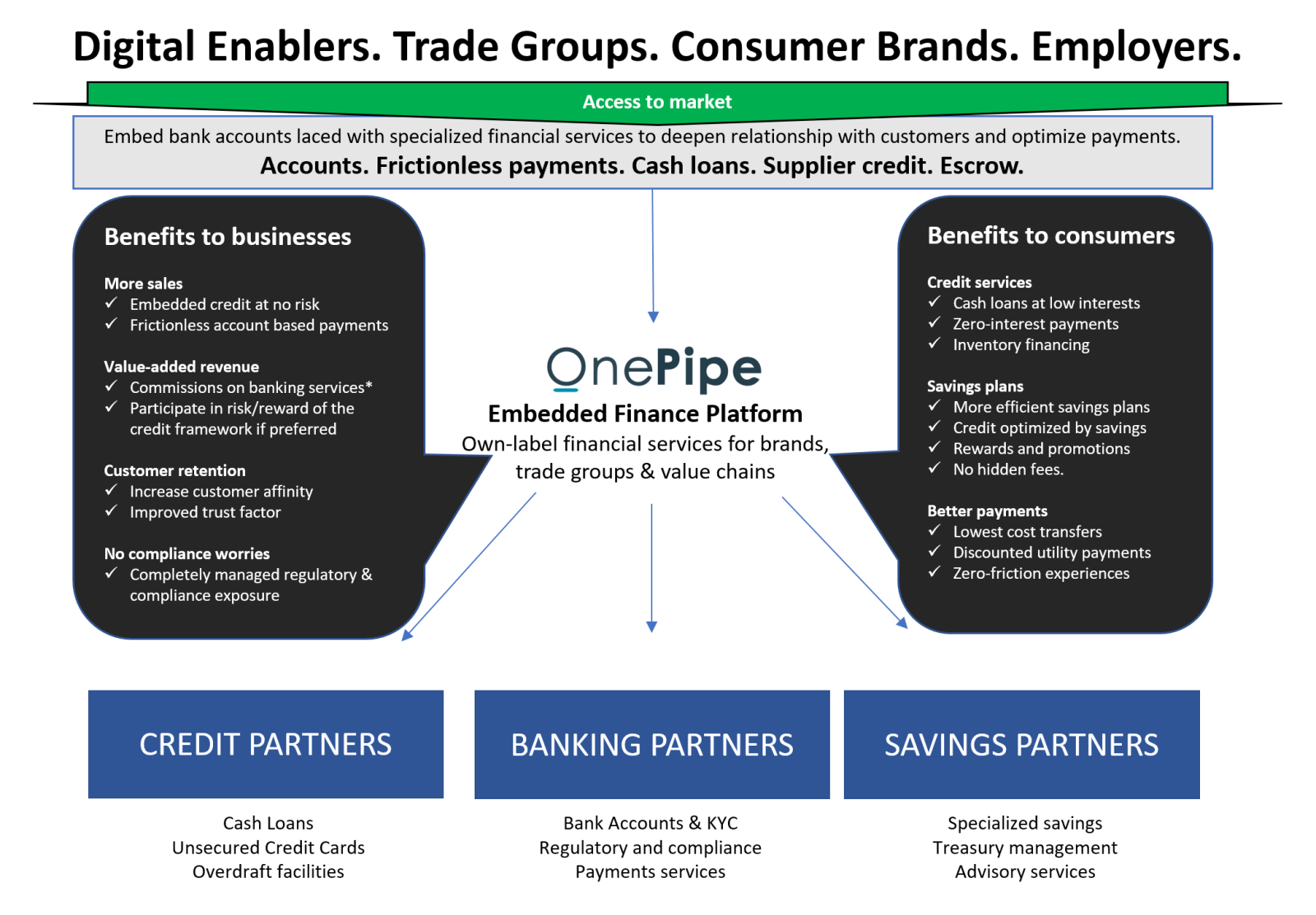

Under the arrangement above, all of the "VI companies" who probably find it unprofitable to serve Karo, can simply provide their corporate services to the organisations (trade groups, FMCG distributors, religious bodies, etc.) - a model that best suits their modus operandi - and let those organisations closer to the grassroots deliver it. And what those organisations closer to the grassroots will do is:

- Use the scale they can marshall to negotiate "corporate" pricing

- Compose services from the different sources to meet what best meets the needs of their own customer

- Create sub-distributor programs to reach a wider audience

Everyone benefits. The reach and depth of financial access is improved, large financial institutions can stay in their comfortable corporate operations, the access organisations improve loyalty and stickiness of the audience they have, the CBN is happier. Eveyone benefits.

As long as we no greedy.

OnePipe's Grassroots Banking

Our idea with Grassroots Banking is to create the framework and tech infrastructure that makes it possible to realise the objectives above. Several organisations, some forward thinking banks inclusive, have agreed to come with us on this quest. We have recently also been joined by a new set of supporters this year who are backing us with the capital and combined experience from other markets to achieve this. We believe technology can help to bridge the scale gap, and partnerships can help to bridge the delivery and fragmentation gap.

Each entity will hol' their side and make sure they remain regulatory compliant while tech infratstructure and partnership rules stitches it all together. With a framework like the above, then propositions like below can be made possible:

And it can be delivered via agents and digital channels that can be slowly teased to consumers to adopt and evolve away from cash gently...

It's like MVNO, but for financial services.

In another post, I'll delve a little bit more into how this virtual banking platform is designed to take all the heavy lifting away from our partner banks and businesses, while not disrupting their current operational and compliance processes. And how it's built to be multi-bank and multi-FI from ground up. Actually, let me go and coax Victor, Kevwe or Segun to write that one, let's share this work. :)

We think this opportunity is sizable, many african markets have the exact same demographics and inherent distribution challenges (maybe not as acute in the mobile money markets, but still exist), and the next big bank will not be a bank, it would be a network of multiple players under a common theme to properly bank the next billion.

In conclusion

Our belief is that to drive increased financial access (and create more value with an increased market size), everyone working together is a more cost effective approach and creates value for all parties.

As we say at OnePipe:

The world needs a new type of financial services ecosystem. One where everyone has a role to play, and everyone has some value to capture. And while there's a need for some gatekeepers, their influence needs to be minimal.

Let's go together.

- Banner image credit: Frans Lemmens/Alamy via theguardian.com

- Big shout out to Prof. Olayinka David-West and team for the insights from their SOTM report on DFS in 2020