Schooled: how credit card schemes work and it's effect on electronic payments

There I was, sitting at my desk jeje. Then Alicia says "Hey Ops, come look at this..." in that her Jamaican accent. She showed me this image.

There I was, sitting at my desk jeje. Then Alicia says "Hey Ops, come look at this..." in that her Jamaican accent. She showed me this image.

I laughed hard. But then, it brought back something that had always confused me. I couldn't get it. How the hell do credit cards work? I have never understood the economics of it.

It didn't make sense to me at all how someone would ask you to borrow money, and all you have to do is pay back 10% of what you borrowed every month.

As I was musing on this, I decided to challenge Omotunde, our finance-minded guy leading M&A. "Hey dollar man" (we call him dollar man because he only discusses our investments in dollars), "can you break it down to us how credit cards work, commercially?".

Turns out quite a number of people were interested in this topic. Ivie jumped up. Shola jumped up. Kunle left his seat to participate.

Interesting.

After a lot of back & forth and arguing, we hadn't made headway.

Ivie's position: Credit card schemes make money by waiting for people to default and then charge exorbitant late fees. We all disagreed. Nobody models a business on default. You won't get investor dollars.

Sola's position: They make money on the interest they charge monthly for usage. He couldn't explain what then happens when they say no interest charged if you pay 10% of what you use.

Babajide was just there looking confused. Alicia who started this problem for us also had no clue so she buried her head in her laptop.

Sigh.

Then it hit us, when we gave Omotunde a chance to talk.

Here's his breakdown

Let's assume you got a credit card with a limit of N100.

They tell you that as long as you pay back 10% of what you use, you don't have to pay interest.

Month 1

What you did

- You maxed out the N100. So you are owing N100

- You did 5 transactions from which the fund made N5 in issuer fees.

- You paid back N10 on time.

Credit card company position

- When you borrowed N100, the fund went down to -N100

- When you did the transactions, the fund gained +N5 in fees

- You now have access to N10 with an outstanding debt of -90

The fund has +5 in fees and -90 in debt (receivables)

Month 2

What you did

- You maxed out the N10 you have access to again. So again, you are owing N100

- You did 5 transactions from which the fund made N5 in issuer fees.

- You paid back N10 on time.

Credit card company position

- When you borrowed N10 again, fund went down to -N100

- When you did the transactions, the fund gained +N5, in fees

- You now have access to N10 with an outstanding debt of -90

The fund has +10 in fees and -90 in debt (receivables)

Month 3

What you did

- You maxed out the N10 you have access to again. So again, you are owing N100

- You did 5 transactions from which the fund made N5 in issuer fees.

- You paid back N10 on time.

Credit card company position

- When you borrowed N10 again, fund went down to -N100

- When you did the transactions, the fund gained +N5, in fees

- You now have access to N10 with an outstanding debt of -90

The fund has +15 in fees and -90 in debt (receivables)

I hope you can spot the pattern...

The credit card company continues to make more money every month in issuer fees, while at any point in time, you could still be owing them in receivables.

At some point, the credit card company will make as much from usage fees (monthly fees, issuer commision from the card scheme, as well as any other "hidden fees") that would exceed what you borrowed and you'd still be owing them. In accounting terms, what you owe them still counts as money to them. What they have made in fees has already covered what they advanced you and still generating profit going forward. It's a risky, but good business.

This gave me an Aha! moment that explained why in the west, electronic payments are led by credit cards and not debit cards. Why? Those societies have solved most of the issues that make credit risky. Issues like identity, social security, employment rate (and employability), etc. Because these problems are largely solved, credit abounds. And you use your credit card more than you use your debit cards. It also explains why credit cards try to remove every impediment from using your card.

- 1 click payments

- No PIN

- Etc...

The easier they make it for you to spend from your card, the more they make in fees. So they remove all barriers.

If you let yourself get defrauded, your credit worthiness takes a hit, so you do your best to stay safe.

In Nigeria here, our payment infrastructure is largely debit-cards/prepaid-wallets and not credit-based. Hence, banks and players have put all sorts of impediments to getting money out of your account in the name of risk management (Oh Tee Pee anyone?).

Anyway, I digress.

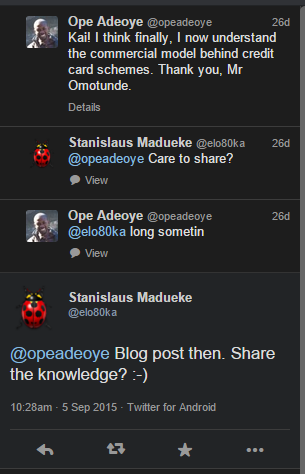

So Stan, I have written down my understanding of how credit cards work. As you requested.